Financial Literacy

Level up your money game with curated tips and insights. Built to help every Ghanaian worker build wealth.

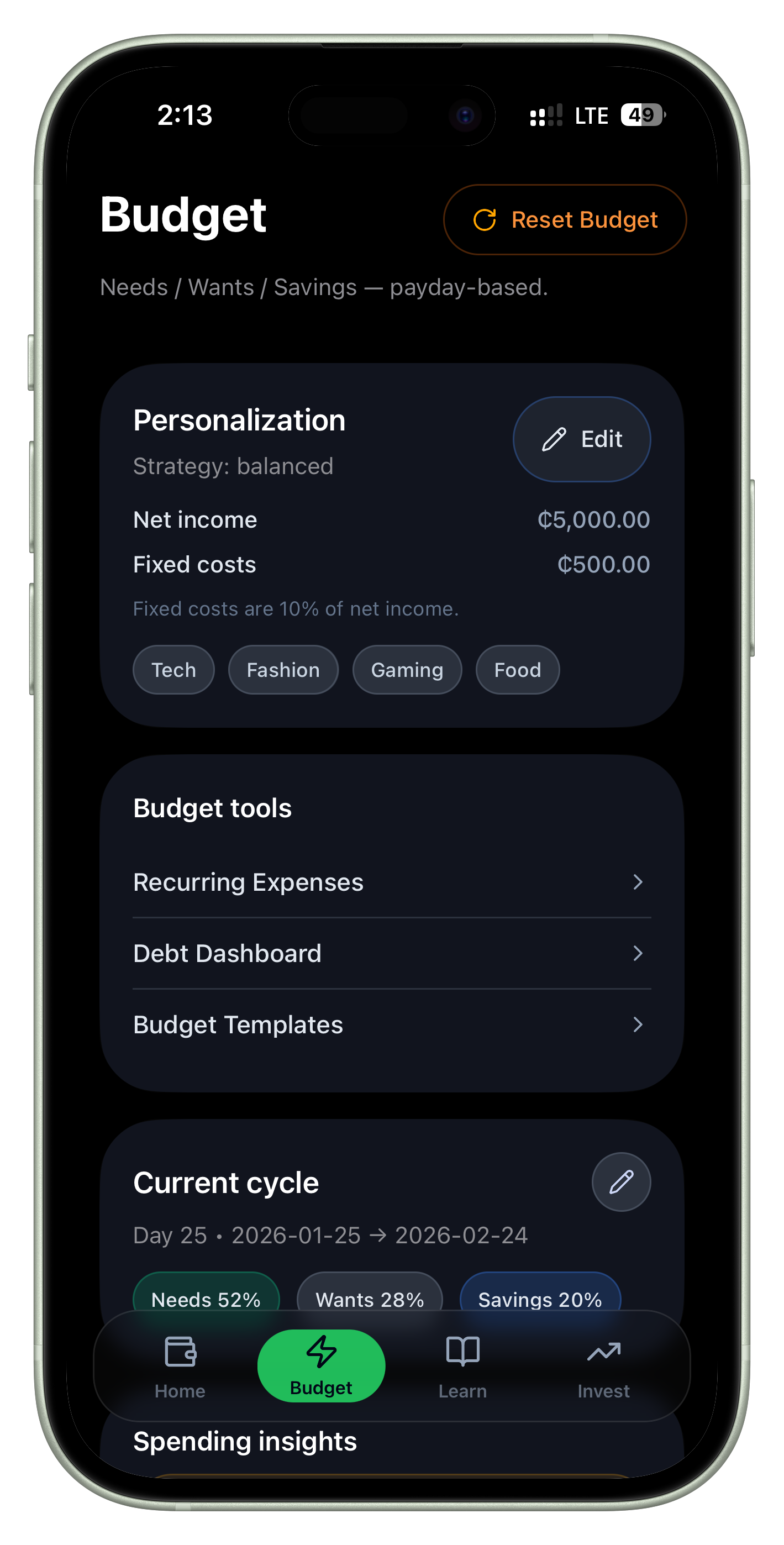

Key features

Curated lessons

Short, practical lessons on budgeting, saving, investing, and avoiding debt. No jargon.

Ghana context

Content tailored to Ghana — mobile money, Treasury Bills, GSE, local banks, and real-life scenarios.

Learn at your pace

Complete lessons in a few minutes. Build habits over time without overwhelm.

Action-oriented

Every lesson includes a small action you can take today. Knowledge becomes behavior.

Growing library

New content added regularly. Stay informed on savings, investments, and financial wellness.

Free for everyone

Financial literacy shouldn't cost money. CediWise lessons are free for all users.

How it works

Access bite-sized lessons on budgeting, saving, investing, mobile money, and avoiding debt. Each lesson is designed to be completed in under 5 minutes. Track your progress, revisit topics, and apply what you learn directly in the CediWise app.

Built for Ghana

Our content reflects real Ghanaian contexts: MTN MoMo, Vodafone Cash, Treasury Bills, the Ghana Stock Exchange, local banks, and common financial pitfalls. No generic advice — we speak your language and your economy.

Why it matters

Financial literacy is one of the biggest gaps holding Ghanaians back. Many people earn well but struggle to save or invest. Education changes that. With CediWise, you get tools and knowledge in one place — so you can plan, save, and invest for a rainy day.