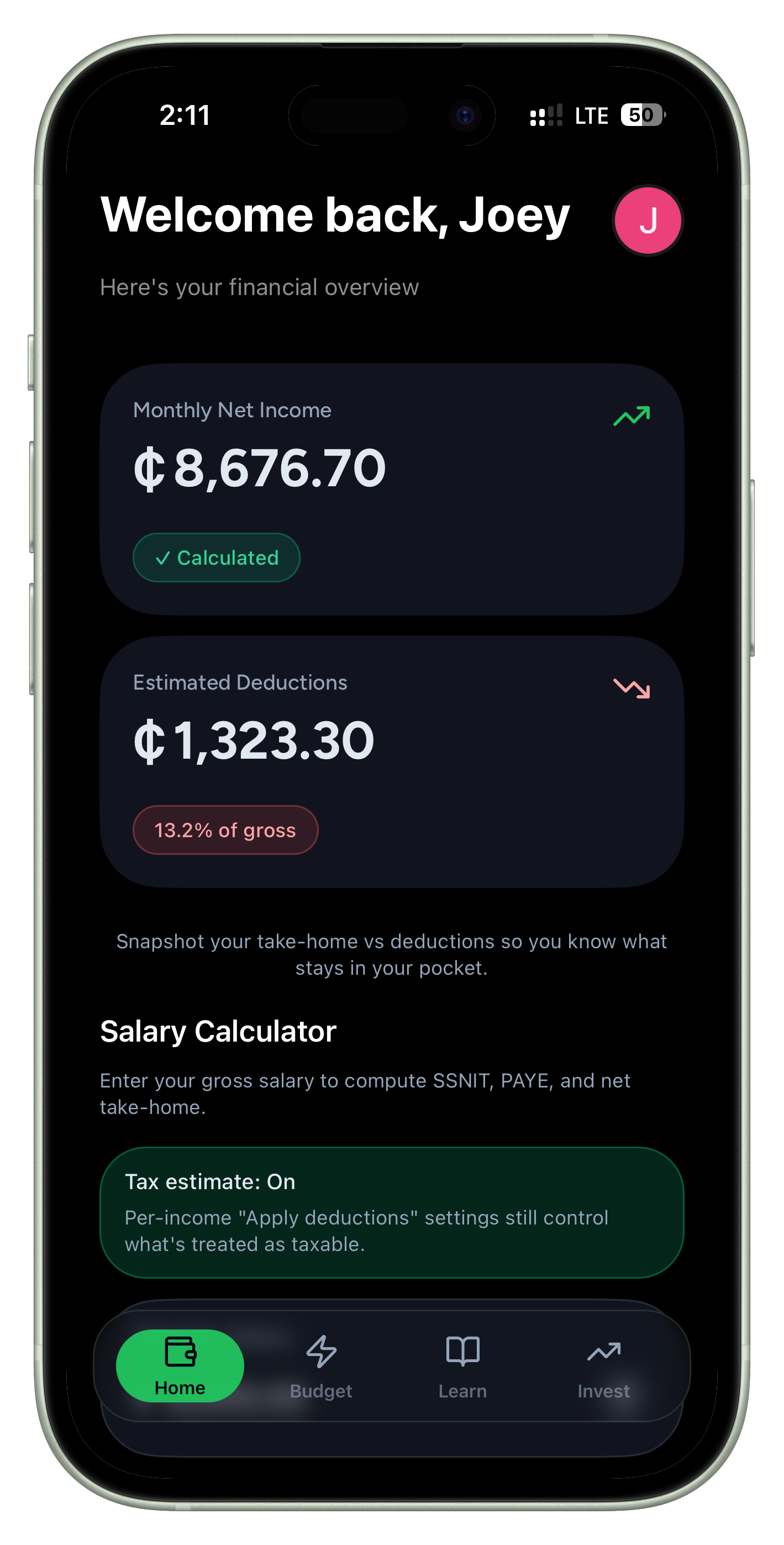

Salary Calculator

Calculate SSNIT, PAYE, and net take-home for Ghana 2026. Know exactly what stays in your pocket after all deductions.

Key features

SSNIT & PAYE

Automatic calculation of SSNIT contributions and PAYE tax based on current Ghana Revenue Authority (GRA) rates.

Net take-home

See your exact take-home pay after all statutory deductions. No surprises on payday.

GHS 2026 rates

Built for Ghana 2026 tax brackets and thresholds. Stay compliant with the latest regulations.

Salary breakdown

Clear breakdown of gross salary, SSNIT, tier-2, PAYE, and net salary at a glance.

Multiple scenarios

Compare different salary levels and understand how deductions change as income grows.

Export & share

Save or share your salary breakdown for record-keeping or loan applications.

How it works

Enter your gross monthly salary and the CediWise salary calculator applies the correct SSNIT (tier 1 & 2) and PAYE rates according to GRA guidelines. You get an instant breakdown showing exactly how much goes to tax, pension, and your pocket.

Built for Ghana

Our calculator uses the latest Ghana Revenue Authority tax tables and SSNIT contribution rates. Whether you're a first-time earner or managing a growing income, you'll have clarity on your finances.

Why it matters

Understanding your take-home pay is the first step to budgeting and saving. Many Ghanaians are surprised by the gap between gross and net salary. With CediWise, there are no surprises — just clarity and control.